Statement From The Chairman’s Office

Statement From The Chairman’s Office

“Our enhanced capacity, our position as a cost competitive producer, our state-of-the-art equipments, cuttingedge technology and our strong business relations with leading steel producers across the world should allow us to capitalise on emerging opportunities effectively and efficiently.”

Dear Shareholders,

I am immensely pleased to write to you, especially because we achieved the best results among our peers in a year challenged by heightened geopolitical stress, unprecedented inflationary pressures and supply chain constraints. It has been a momentous year as our

new capacity became fully operational in Nov’23 and is working perfectly well. At 100,000 tons, we are the world’s largest single-location facility for manufacturing graphite electrodes and the third-largest graphite company in the Western world. It’s a moment of joy for everyone at HEG who has made this possible. I am sure you would also experience a sense of pride with this achievement.

Our Performance

The growth of graphite electrode sector is closely dovetailed with the fortunes of the global steel industry. The world steel production in 2023 somewhat matched the production in 2022. The US steel market remained stagnant, while production in the EU dipped by about 7%. Besides China, India was the only large steel producing nation to register healthy growth. Owing to the subdued steel demand and production, the demand for graphite electrodes remained tepid.

We, too, felt the heat of the moderated demand since the lion’s share of our output goes to steel mills globally. Despite the dismal demand, I am pleased to mention that your Company achieved capacity utilisation of 81%. However, the increase in output did not cascade into profitable business growth. Our topline and bottom line were significantly impacted by the pricing pressure on graphite electrodes. Our Revenue from Operations dipped by 3% to C72 crore, and our Net Profit slipped by 49% to C224 crore.

Immediate Prospects

The global economic uncertainty will limit steel demand and constrain steel production. As a result, we do not see much improvement in steel production in 2024 due to the expected subdued demand for our products for the next few quarters. On a positive note, we have exhausted all old high-priced needle coke inventories, WIP and finished goods, and this year, we will be using the lower-priced needle coke (purchased in FY24), which should help us sustain business profitability. Moreover, by the end of 2024 (calendar year), we hope to see the green shoots of recovery.

Medium / Long Term Prospects

While the scenario for the current year does not appear promising, we are positively upbeat about our prospects over the medium / long term. There are two parts to our optimism story, which I shall briefly articulate.

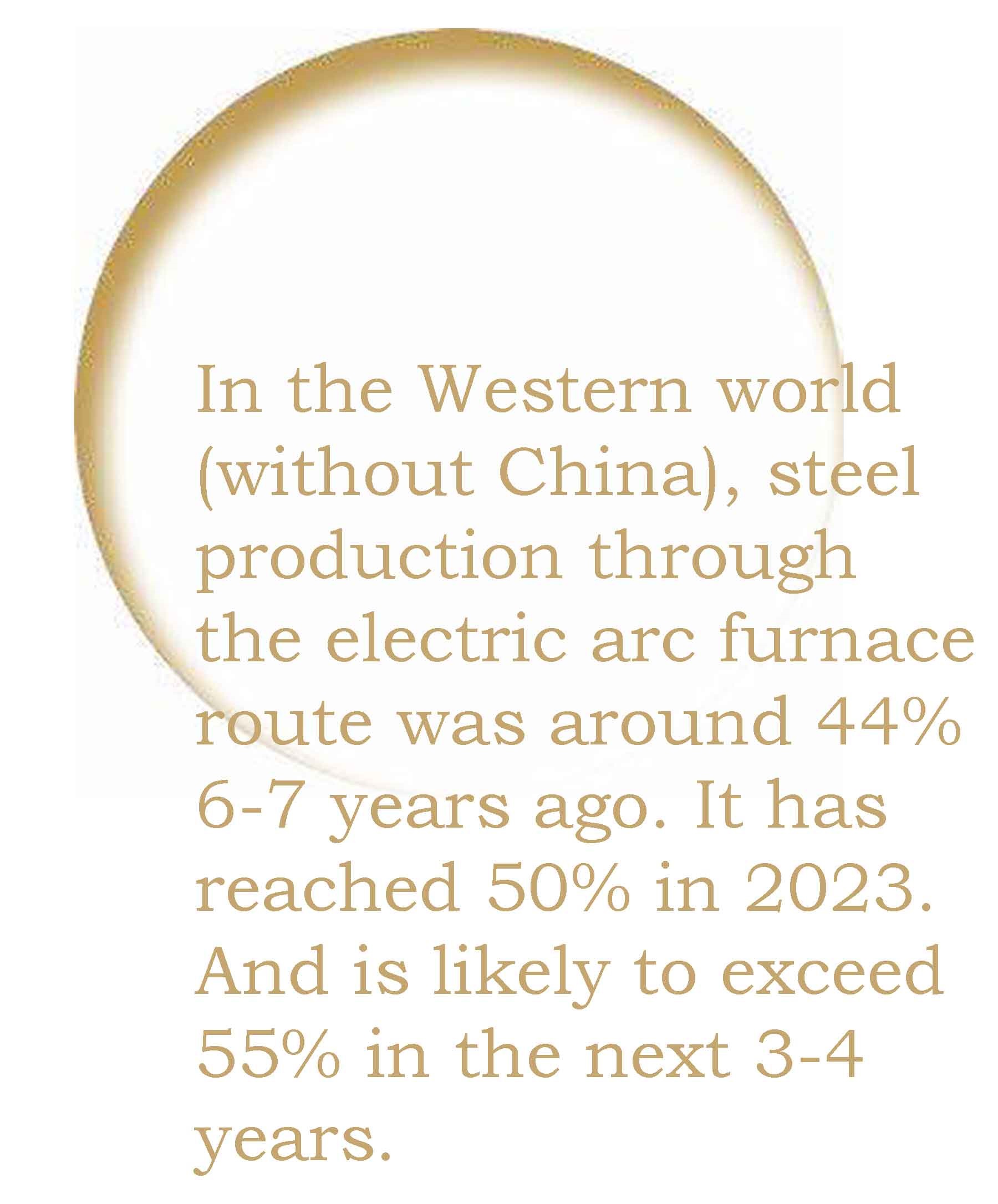

- Electric Arc Furnace scenario As steel companies embrace sustainable practices worldwide, decarbonisation efforts have increased intensely to the extent of becoming an irreversible priority. America, Europe and other parts of the World are working overtime to adopt cleaner steel-making technologies. They have and continue to make massive investments to convert their steel-making infrastructure into environment-friendly assets. As a result, greenfield electric arc furnaces are being announced regularly, with the US and EU leading this trend. More than 90 million tons of greenfield capacities have already been announced in different parts of the world to come on-stream by 2030, a number which will steadily increase as more and more steel companies switch over to cleaner ways of steel making. Aligned with this transformation in steel making, we expect graphite electrode demand to increase gradually by about 150,000 to 200,000 tons by 2030. This is a large increase considering the current demand of about 500,000 to 550,000 tons for ultra-high-power electrodes (excluding China).

- Graphite electrode scenario While the medium / long term demand situation is particularly promising, supply over the same period will likely fall short of demand. I draw this conclusion for two reasons

-

- Capacity closure: Some electrode producers have shut down significant capacity in the last decade owing to the slump in demand consequent to the pandemic. More recently, a leading graphite electrode producer has announced a closure of its 25,000 ton capacity.

- No capacity addition: Other than HEG, no other player (excluding China) has announced any capacity addition. Moreover, if any capacity addition is announced now, it would take anywhere between 3 to 5 years for any new capacity to commence operations.

We believe that the opportunity runway for the next 4-5 years appears encouraging. Besides, as we move beyond 2024, we hope for sustainable demand for our products.

What Went Right For HEG

Essentially, three factors worked for us. A bit of good luck. A lot of brainstorming. And immense hard work in execution. We capitalised well on the appreciable uptrend of 2017 and 2018 in our business space. Utilising the proceeds for capacity expansion was a foregone conclusion as this was our only business. We took a difficult decision to expand our capacity from 80,000 to 100,000 mt at a time when COVID-19 struck. In retrospect, I am pleased to say that we got our timing right – from conceptualization to execution. Our additional capacity is ready, when the sector is perfectly poised for a riveting upturn over the coming years.

Our enhanced capacity, our position as a competitive-cost producer, our stateof- the-art equipments, cutting-edge technology, and our strong business relations with leading steel producers worldwide should allow us to capitalise on emerging opportunities effectively and efficiently.

Our New Venture India’s EV dream is steadily taking shape as automotive OEMs launch electric mobility variants rapidly. Also, rising environmental consciousness and increasing availability of charging infrastructure and solutions are driving the adoption of electric vehicles.

Leading battery manufacturers have announced and are also implementing capacity creation, which is about 50 GWh, which requires about 50,000 tons of graphite anode powder.

India’s critical Achilles heel in this ecosystem is anode powder, as India does not produce anode powder. Recognising this opportunity, our Board has approved the proposal of setting up a 20,000-ton graphite anode powder plant at an investment of C1800 crore.

I am happy to mention that we have made significant headway in this venture. One, we have acquired the land for the project and started constructing the facility. We intend to complete it by mid-2025. If everything goes according to plan, we should generate revenue from this venture in FY27.

Two, we will use renewable energy to operate our facility. We are in conversation with renewable energy players to secure long-term power purchase agreements. This is a commitment towards reducing our carbon footprint.

Three, we have a state-of-the-art pilot plant producing around 10 tons of anode powder per month. We have started sampling with some large companies and are trying to work with them to develop customised products that match their requirements.

Three, we have a state-of-the-art pilot plant producing around 10 tons of anode powder per month. We have started sampling with some large companies and are trying to work with them to develop customised products that match their requirements.

I would like to reiterate that our timing is our advantage. While some other players may enter this space, our proactive thinking and swift execution position us as the first committed player in this exciting business space.

We are optimistic about positively contributing to India’s electric mobility ambition as our new facility commences operations.

In Closing

The principal message I would like to send out is that we are FUTURE READY. Our future is built on a strong base. We have put our resources into areas that ensure long-term success. Our financial stability, a skilled and passionate team and clear vision allow us to proactively align with the winds of change and thrive to unlock immense value for our stakeholders.

I express my sincere appreciation to all our stakeholders for their confidence and support. I am certain that we will script an exciting growth journey ahead. Looking forward to our prosperous future at HEG.

Warm regards

Ravi Jhunjhunwala

Chairman, Managing Director & CEO